- TOP

- ESG Policies / Management System

- Governance

Governance

Governance

Governance of the Investment Corporation

In addition to the General Meeting of Unitholders, which is composed of unitholders, the organization of KDX Realty Investment Corporation(“KDXR”) consists of the Board of Directors, which is composed of an Executive Director and Supervisory Directors, and an Independent Auditor. The number of supervisory directors must be the number of executive directors plus one or more.

The Board of Directors of KDXR is required to meet at least once every three months. In actual operations, Board of Directors meetings are held about once a month in principle. At the Board of Directors, the Executive Director reports on the operational status of Kenedix Real Estate Fund Management, Inc (“KFM”) and the General Administrator. The directors and employees of KFM and the General Administrator also provide detailed reports on the status of business execution as needed. The Independent Auditor is EY Ernst & Young ShinNihon LLC.

The Executive Director is responsible for the execution of KDXR’s businesses and is authorized to take any judicial or out-of-court actions with respect to KDXR’s operations. The Supervisory Directors have the authority to supervise the execution of duties by the Executive Director.

Investment Corporation Management Structure

KDXR has entrusted the management of its assets to KFM, in accordance with the provisions of the Investment Trust Act. KFM manages KDXR’s assets under an asset management contract with KDXR.

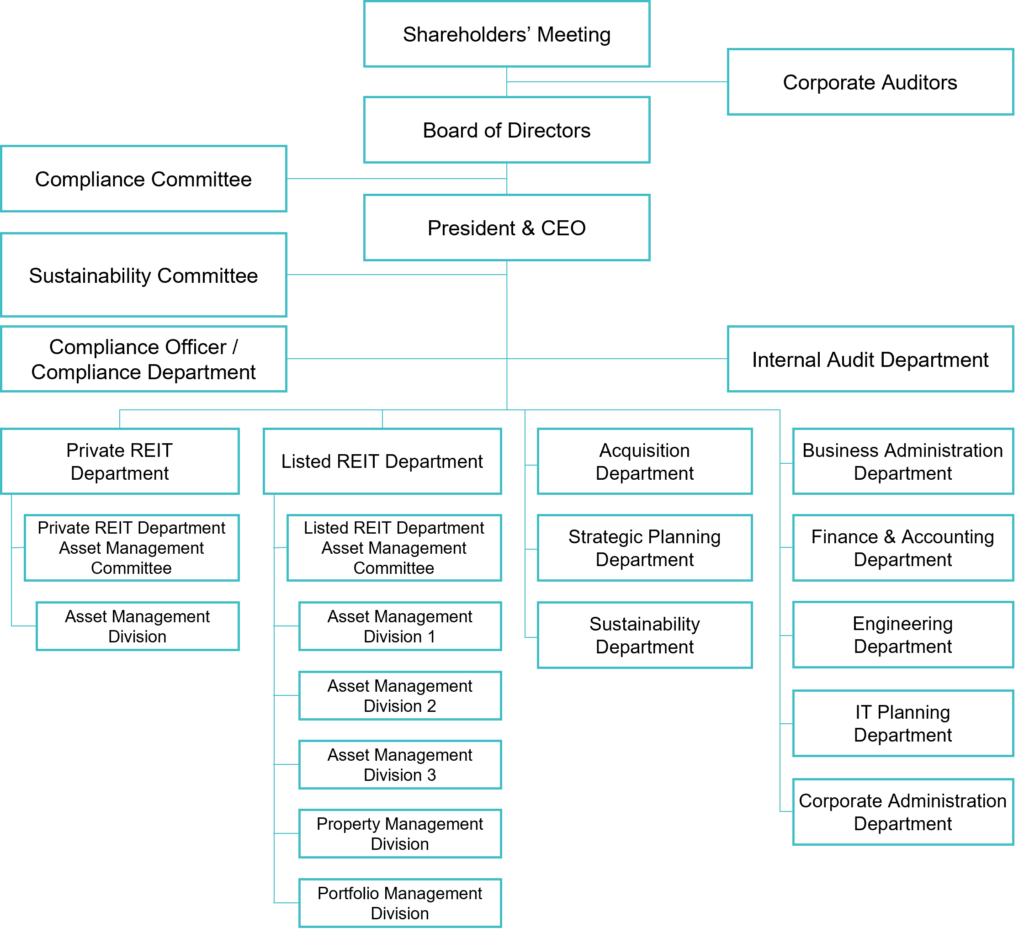

Concerning the organizational chart of KFM, please refer to following.

Organization chart

Board of Directors

| Committee Members | The Committee is chaired by the President and consists of all directors. |

|---|---|

| Frequency of Meetings | At least once every three months. However, meetings may be held as needed. |

| Tenure | Until the close of the general meeting of unitholders relating to the last fiscal year ending within two years after the election |

| Resolution Method | Resolutions of the Board of Directors shall be adopted by a majority of the votes of the directors present at a meeting where a majority of the directors who are entitled to participate in the voting are present. Directors with special interests may not participate in the voting. |

| Matters to be Resolved | Matters concerning KFM’sGeneral Meeting of Shareholders Matters related to shares and bonds, etc. Matters related to the Board of Directors, officers, and important employees Matters related to the organization, rules, etc. Matters concerning KFM’s business Disposition and transfer of important assets Matters related to significant borrowings Approval of internal audit (inspection) plans and improvement plans, etc. |

| Compliance System | The Board of Directors determines the basic policy for compliance activities as well as other basic items concerning compliance. The Board of Directors can ask the Compliance Officer and Compliance Committee to submit reports as needed concerning the status of compliance activities. The Compliance Officer submits proposals for the establishment of a compliance manual and a compliance program, as well as revisions. These proposals are first examined and approved by the Compliance Committee. The proposals then go to the Board of Directors for final approval. As a rule, a compliance program is established for every fiscal year and the Compliance Officer promptly submits progress reports to the Board of Directors. In addition, the Compliance Officer submits internal audit reports and clerical accident reports in a timely manner or periodically. The Board of Directors makes decisions on appointments of the following important positions regarding the management of REIT assets by KFM. Individuals who are selected must have outstanding character and knowledge along with the skills needed to perform the assigned duties. (1) Outside member of the Compliance Committee (2) Outside members of the asset management committees of each department (3) Compliance Officer In addition, the outside members of the asset management committees of each department must be certified real estate appraisers and the outside member of the Compliance Committee must be either an attorney or a certified public accountant. |

Compliance Officer

The Compliance Officer works on the establishment of compliance system in the Asset Management Company and the creation of a corporate culture that abides by laws and regulations, as well as rules.

The Compliance Officer ensures that the necessary relevant documents are prepared in conjunction with the presentation of such an agenda as the establishment/change of management guidelines and asset management plans for the respective departments and the acquisition of individual assets, and conducts preliminary examinations regarding whether there are any serious problems in terms of compliance, such as the violation of laws and regulations.

The Compliance Officer also administers matters regarding compliance in KFM as a chairperson of the Compliance Committee. Specifically, the Compliance Officer is assigned with duties such as drafting and improvement of compliance manuals and compliance programs, as well as periodical instructions and trainings to executives and employees and the inspection of compliance with laws and regulations, based on compliance programs.

Compliance Committee

| Chair | Compliance Officer |

|---|---|

| Committee Members | The President and Representative Director, the Compliance Officer, the director(s) (if any) in charge of the proposals to be discussed by the Committee who currently holds such position, and the external committee members |

| Functions | Deliberations and resolutions on matters related to overall compliance |

| Roles | The Compliance Committee examines all other important matters involving compliance and reaches decisions, which are reported to the Board of Directors. The compliance manual and compliance program proposals submitted by the Compliance Officer are examined and approved by the Compliance Committee. The proposals then go to the Board of Directors for final approval. As a rule, a compliance program is established for every fiscal year and the Compliance Officer promptly submits progress reports to the Board of Directors. |

Compliance

Strict compliance with laws, regulations and other guidelines is positioned as a vital element of the management of Kenedix based on the awareness that compliance problems are a significant risk regarding business operations.

We have a responsibility to use business operations to create the types of value that meet social requirements.

We have extensive and constant compliance programs in order to achieve qualitative and quantitative improvements of the value of our business operations.

By implementing a rigorous compliance program, we are determined to contribute to economic and social advancement and, as a result, earn the admiration of investors and the trust of the public.

Compliance is one of our material issues and the entire group has a strong commitment to compliance.

The Decision-Making Process

KFM manages the assets of KDXR under a discretionary asset management contract with KDXR. In this role, KFM establishes asset management guidelines, investment policies, related party transaction rules, distribution policies, disclosure policies and other basic policies regarding the asset management of KDXR.

For the asset management of KDXR, KFM prepares an asset management plan and other documents (in addition to the asset management plan, medium-term and annual business plans) in accordance with the asset management guidelines. Based on the investment policy stipulated in the asset management guidelines and the related party transaction rules, properties to be acquired or sold are selected and the transactions are subsequently executed.

Transactions with related parties as prescribed in the Investment Trust Act and related parties as prescribed in the Related Party Transaction Rules require the approval of KDXR Board of Directors and based on this resolution, the agreement of the KDXR Executive Director. However, this requirement does not apply for certain types of transactions.

Responding to Anti-Social Forces

KFM has prepared a Manual for Responding to Anti-social Forces and the Prevention of Transfers of Criminal Proceeds. To reject relationships of any kind with anti-social forces, KFM has a resolute stance for refusing to deal with criminal and other anti-social forces.

KFM confirms that buyers and sellers of properties, tenants, business partners, and other transaction counterparties are not anti-social forces. In addition, KFM requires all contracts to include provisions for refusing to deal with anti-social forces and performing confirmations in accordance with the Act on Prevention of Transfer of Criminal Proceeds when conducting transactions. Consequently, KFM is taking concrete actions for the purpose of preventing relationships with anti-social forces.

Measures against Money Laundering and Terrorist Financing

KFM has prepared a Manual for Responding to Anti-social Forces and the Prevention of Transfers of Criminal Proceeds and properly performs confirmations in accordance with the Act on Prevention of Transfer of Criminal Proceeds when conducting transactions. These activities are used to confirm the identities of transaction counterparties as well as their attributes, business activities and purpose of the transaction. Risk identification, evaluation and reduction measures are implemented from the perspective of the risk-based approach specified in the Guidelines Concerning Money Laundering and Financing of Terrorism of the Financial Services Agency.

Anti-Bribery and Anti-Corruption Policy

Strict compliance with laws, regulations and other guidelines is positioned as a vital element of the management of Kenedix based on the awareness that compliance problems are significant risks regarding business operations. The Asset Management Company strives to prevent corruption by establishing specific policies on “Prohibition of bribery”, “Prohibition of embezzlement, fraud, theft, and other criminal acts” and “Prohibition of insider trading” in our “Employment Regulations” and “Compliance Manual”. Any violation of these policies will be subject to disciplinary action in accordance with the “Employment Regulations”.

Furthermore, compliance awareness is raised by regular training on a wide range of legal and compliance issues through compliance training for new employees and for all officers and employees (including temporary employees).

In fiscal year 2023, there were no cases of “Incidents related to fraud or corruption”, “Dismissals or termination related to fraud or corruption”, “Costs of fines, penalties, or settlements related to fraud or corruption” in the Kenedix Group. Moreover, there were no record of political contributions.

Entertainment/Hospitality and Prohibition of Bribery

The Asset Management Company has set rules such as “Prohibition of entertaining clients and giving gifts to public service officials”, “Prohibition of requesting entertaining clients and giving gifts from business partners beyond a reasonable range”, and “Prior approval when providing entertaining clients or giving gifts”.

We are committed to prevent the corruption in accordance with the National Public Service Ethics Law, the National Public Service Ethics Code and regulations.

We regularly verify that each entertainment and hospitality is properly conducted by internal rules, and the records of such activities are kept and monitored. The operation of these anti-corruption & bribery rules is subject to internal audit.

Due Diligence on New Business Partners and Brokers

The Asset Management Company conducts due diligence by checking the anti-social forces and information management systems for the “transactions with new business partners and brokers, others”. In addition, the Compliance Manual stipulates the rule of “prohibition of bribery, others at the time of selecting business partners, others.”

Response to Violation Occurrence

Employees are required to report to the department head or the Compliance Officer when one discovers a compliance problem such as bribery, or receives a suggestion from others of existence of a compliance problem, or is concerned regarding possible compliance violation. If the Compliance Officer deems it necessary in compliance with various laws, regulations and rules, the Compliance Officer reports to the President & CEO, the Compliance Committee, the Board of Directors, and appropriate action will be taken.

The employees (including directors, regular employees, contract employees, temporary employees, part-time employees, dispatched employees and workers stationed within our company on subcontracting, those who have made a report within one year from leaving the company) may also utilize the whistleblowing system, which allows anonymous reporting.

Whistle-Blowing System

KFM has a whistleblowing system for the prevention and rapid discovery of incidents caused by violations of laws and regulations and other improper conduct, the improvement of self-cleansing processes, the control of reputational risk exposure, and the retention of public trust. Our whistle-blowing policy applies to all the employees including directors, full-time employee, elderly employee, contact employee, part-time employee, assigned / temporary employee from the other company, and former employee left within 1 year of the termination date.

Reporting, Investigation and Disciplinary Processes

If violation of law (including internal company policies) occurs or could occur and if the matter has not been satisfactorily resolved by ordinary procedures, the company accepts reports, declarations, and consultations from internal and external contacts. Anonymous reporting is also accepted.

The person in charge of handling whistleblowing shall conduct fair and impartial investigation. The respondent will be provided with the opportunity to present a defense and the fair hearing is held with relevant persons in compliance with the obligation of confidentiality.

The person in charge of handling whistleblowing reports all results from investigations to the director in charge of compliance and the president, as well as to the board of directors and the council of corporate auditors, including the results of notifications to the whistleblower. The head of the department to which the accused belongs take appropriate action such as immediate order to stop action in violation of law.

Based on the report, disciplinary action and all the other appropriate measures to correct such as criminal prosecution, claims for damages or measures to prevent recurrence shall be taken.

Prohibition of Unfair Treatment

Whistleblowers and those who cooperate with them, as well as those who cooperate with investigations based on the reports, are subject to protection under the whistleblowing system and the Whistleblower Protection Act, and any unfair treatment against the whistleblower are prohibited.

Internal Audit

In order to enhance internal control functions, KFM conducts internal audits annually, covering the operations of all departments and utilizing outside experts.

The Head of the Internal Audit Department of KFM prepares an internal audit plan, which complies with the Internal Audit Rules, as a person in charge of internal audits. After the plan is approved by the Board of Directors, audits are performed in accordance with the plan. Internal audit reports accurately reflecting issues found and raised during audits are prepared. The person in charge of internal audits shares such an internal audit report with the President & CEO and the Board of Directors without delay. Departments that were audited establish a plan for making improvements without delay, factoring in the significance of issues raised, and take the necessary actions. The person in charge of internal audits appropriately oversees progress with improvements at departments that were audited, confirms that improvements have been completed and reflects these activities in the subsequent internal audit plan. To confirm the suitability of the business processes of KFM or for some other reason as needed, the Board of Directors or the person in charge of internal audits can, at their discretion, ask for an external audit by outside experts.

Compliance Training

To ensure that everyone is aware of the importance of compliance, KFM provides compliance training for new employees when they first join the company as well as for all executives and employees, including temporary employees.

| Training content | Date of training | Attendance rate |

|---|---|---|

| Prevention of Conflicts of Interest between Investment Corporations | Apr. 2022 | 96.7% |

| Management of information related to the management of investment corporations | Jul. 2022 | 96.0% |

| Fiduciary Duty as an Asset Management Company (Input) | Aug. 2022 | 98.4% |

| Fiduciary Duty as an Asset Management Company (Case Study) | Oct. 2022 | 98.5% |

| Prevention of insider trading | Dec. 2022 | 97.2% |

Policy for Customer-Oriented Business Conduct

KFM is firmly committed to the asset management of each REIT with the objective of maximizing value for investors. As part of these activities, KFM has adopted the Principles for Customer-Oriented Business Conduct announced on March 30, 2017 by the Financial Services Agency and has established policies for activities that comply with these principles. For details, please visit the following website:

https://kenedix-fm.com/en/kokyaku/

Managing Conflicts of Interests

Managing conflicts of interest is one of our material issues. The Compliance Manual and other internal rules, etc. has specific policies for the prevention of these conflicts and protection of the company’s assets. Compliance and other training programs give employees a thorough understanding of conflicts of interest and how to prevent them. In addition, we have Related Party Transaction Rules that include processes for making decisions, basic views concerning these transactions and other guidelines. The objective is to prevent transactions with related parties (executives, major shareholders and others) and between these related parties from being detrimental to shareholder value.

Proper Information Management Among the Kenedix Group

The Kenedix Group provides asset management services for a large number of investment corporations and funds on behalf of investors. Kenedix has signed a memorandum with KFM, Inc. and the Investment Corporations managed by KFM and with Kenedix Investment Partners, Inc. concerning the provision of real estate and other information by Kenedix. The proper provision of information by Kenedix and group companies along with the determination of the types of support supplied by the Kenedix Group (and disclosure of this information) ensures the transparency and suitability of the operations of funds and other similar entities.

Rule Concerning Conflicts of Interest Among REITs

Since KFM manages J-REIT and a private REIT, it has established a pipeline committee, that is chaired by the Compliance Officer, and adopted internal guidelines in order to prevent the improper allocation of acquisition opportunities as well as prohibition of concurrent serve as several general managers of REIT management departments, and thus, managing conflicts of interests among the REITs.

By managing these rules appropriately and smoothly, it strives to implement appropriate measures for conflicts of interest, such as preventing arbitrary distribution of real estate sales information and preventing conflicts of interest among the investment corporation managed by KFM.

Risk Management

Risk management is one of our material issues. There are many activities for the proper oversight and control of risk factors.

Risk Management System

KFM stipulates risk management policies, risk management divisions, risk management methods, etc. in its “Risk Management Rules” for the purpose of ensuring sound management and appropriate risk management as an investment management company.

The main risks are defined as investment management risk, real estate management risk, financial risk, legal compliance risk, administrative risk, system risk, and business continuity risk, and a separate management department is designated for each risk.

Each risk management department continuously monitors the status of each risk and, in the event that a significant risk has materialized or is likely to materialize, promptly submits a proposal to the Board of Directors regarding the nature of the risk and the policy for dealing with it.

Each risk management department reviews the items, contents, and response policies of each risk approximately once every two years. The Board of Directors, fully aware of the location and nature of these risks, will oversee the formulation of risk management policies and the development of an appropriate risk management system considering the strategic objectives.

The Board of Directors shall fully recognize the importance of the risk management department and shall take appropriate measures to ensure that the risk management policy is well known within KFM. The Board of Directors will also hold discussions on the risk management system as necessary. The Compliance Officer will oversee the practical management of each risk and support the role of the Board of Directors.

Crisis and Disaster Response System

We have Crisis Management Rules and Disaster Response Rules for natural disasters, incidents, accidents and other problems that have a major impact on business activities or society overall and are detrimental to corporate value. The General Administration and Human Resources Department is responsible for crisis management and disaster response activities. This department establishes an emergency response headquarters to take actions as needed when problem occurs.

In accordance with the KDX Business Continuity Plan, disaster response drills are held periodically, there are measures in place to resume business operations quickly following a disaster or other problem, and other measures to be prepared for a crisis. We periodically reexamine this plan and make revisions as needed.

We also use the following measures to be prepared for a disaster.

- Storage of disaster response kits with food, water and other supplies for executives and employees at business sites

- A safety confirmation system for quickly determining the status of executives and employees after a disaster

- Back-up servers in several locations to protect data

Information Security

KFM has established “Information Management and Protection Regulations” and strives for appropriate information management and protection at the Company by stipulating management methods, management systems, etc. for information handled in the course of business.

For information security management, the Company has appointed a Chief Information Management Officer. The Chief Information Management Officer is appointed by the President and Representative Director, and the Compliance Officer assists the Chief Information Management Officer.

In addition, under the supervision of the Chief Information Management Officer, an information manager (“Information Manager”) has been appointed to effectively implement measures related to the management and protection of the Company’s information. The Information Manager in each department is the head of the department and is responsible for the management and protection of information in each department.

Protection of Personal Information

KFM stipulates in its Compliance Manual that its officers and employees fully recognize the importance of protecting information and privacy, and ensure appropriate and strict management in accordance with internal rules for the handling of confidential business information, personal information, and other internal information, and also ensures that officers and employees are fully aware of the protection of personal information through compliance training, etc. In addition, we ensure that all executives and employees are fully aware of the need to protect personal information through compliance training and other means.

In addition, each REIT and KFM have established a “Personal Information Protection Policy” and “Regulations Concerning Protection of Personal Information” to protect and properly manage personal information.