- TOP

- ESG Policies / Management System

- Environment

Environment

Engaging to our social mission of improving the environmental performance of the properties we manage, we believe that reducing the environmental impact of such properties including energy consumption, GHG emissions, water consumption and waste management, and contributing to environmental sustainability through the continuous reduction of environmental impact as well as reduction and appropriate management of hazardous substances, will contribute to improving our mid- to long- term profit.

- Climate Change

- Environmental Performance

- Reduction of Environmental Burden

- Stakeholder Engagement to Improve Property Performance

Climate Change

Global warming, as the main factor for a climate change, has been the primal topic at international meetings, and in 2015 Paris Agreement has adopted a new framework in 18 years since Kyoto Protocol. In this agreement, one of the goals is to keep the increase in global average temperature to well below 2°C, preferably to 1.5°C, compared to pre-industrial levels. Furthermore, at COP26 in 2021, the Glasgow Climate Pact was agreed that the 1.5°C target remains in sight and scales up action on dealing with climate impacts. In light of the recent increase in extreme weather events, we recognize that efforts to climate change is one of the most important issues for our business activities and properties we manage.

Support for TCFD Recommendations

Kenedix Real Estate Fund Management, Inc (“KFM”) expressed its support for the recommendations made by the Task Force on Climate-related Financial Disclosures (“TCFD”) and also joined the TCFD Consortium, a group of domestic companies that support TCFD recommendations in October 2021.

TCFD is an international initiative established by the Financial Stability Board (“FSB”) at the request of the G20 for the purpose of discussing the disclosures of climate-related financial information and the responses by financial institutions. TCFD publicizes recommendations for companies to disclose their governance, strategy, risk management, and metrics and targets for climate-related risk and opportunities.

Moreover, TCFD Consortium is a group of companies and financial institutions that support the TCFD recommendations. Consortium was established with a view to further discussion on effective corporate disclosures of climate-related information and initiatives to link disclosed information to appropriate investment decisions on the part of financial institutions and other organizations.

KFM, KDX Realty Investment Corporation (“KDXR”), and Kenedix Private Investment Corporation (“KPI”) (KDXR and KPI are collectively referred to as “managed REITs”) will work to expand information disclosure based on TCFD and continue to actively promote ESG (Environment, Social and Governance) initiatives based on “Sustainability Policies” established by KFM.

Governance

For further details concerning governance for climate change, please refer to Sustainability Management System.

Strategy

Scenario Analysis

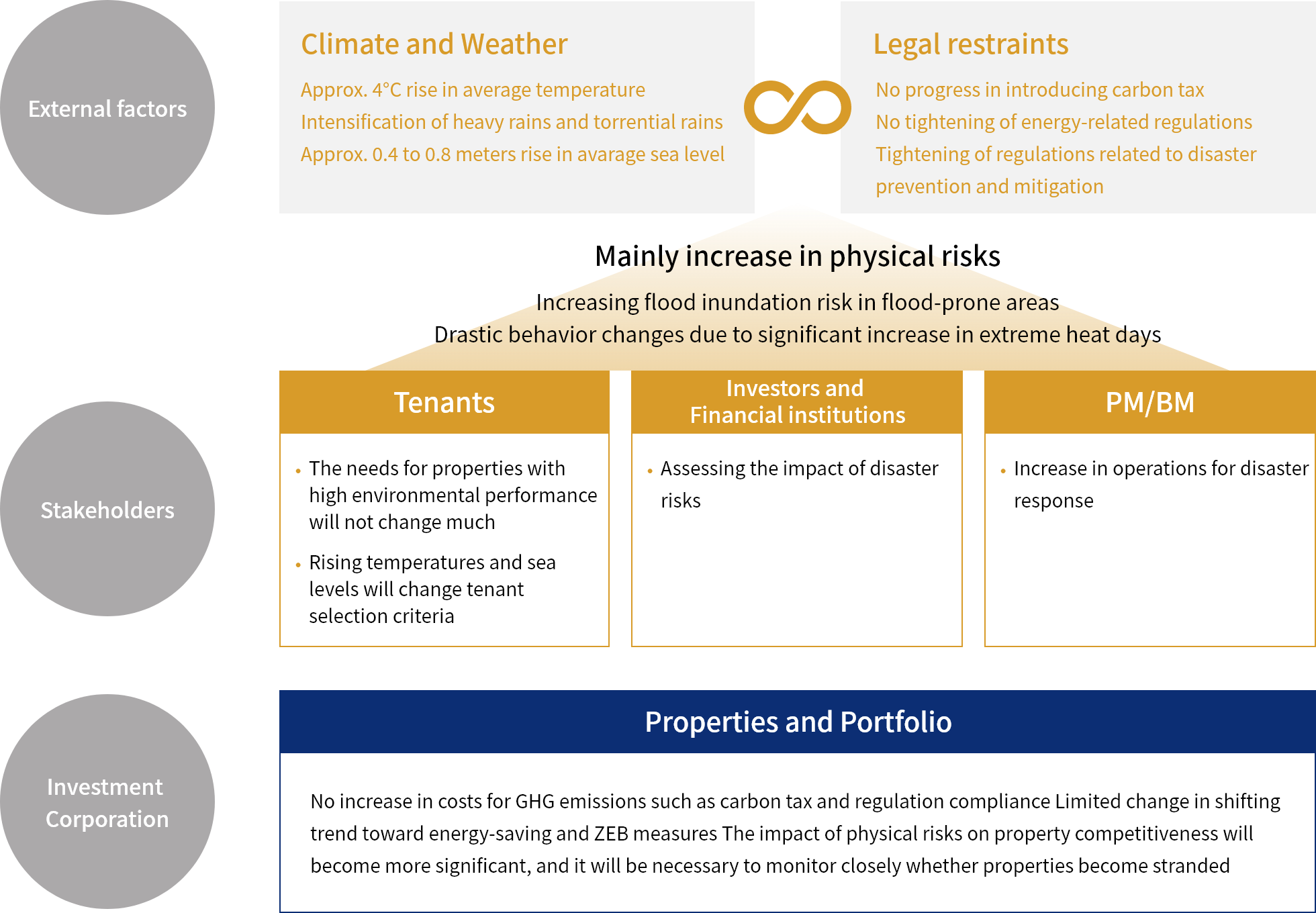

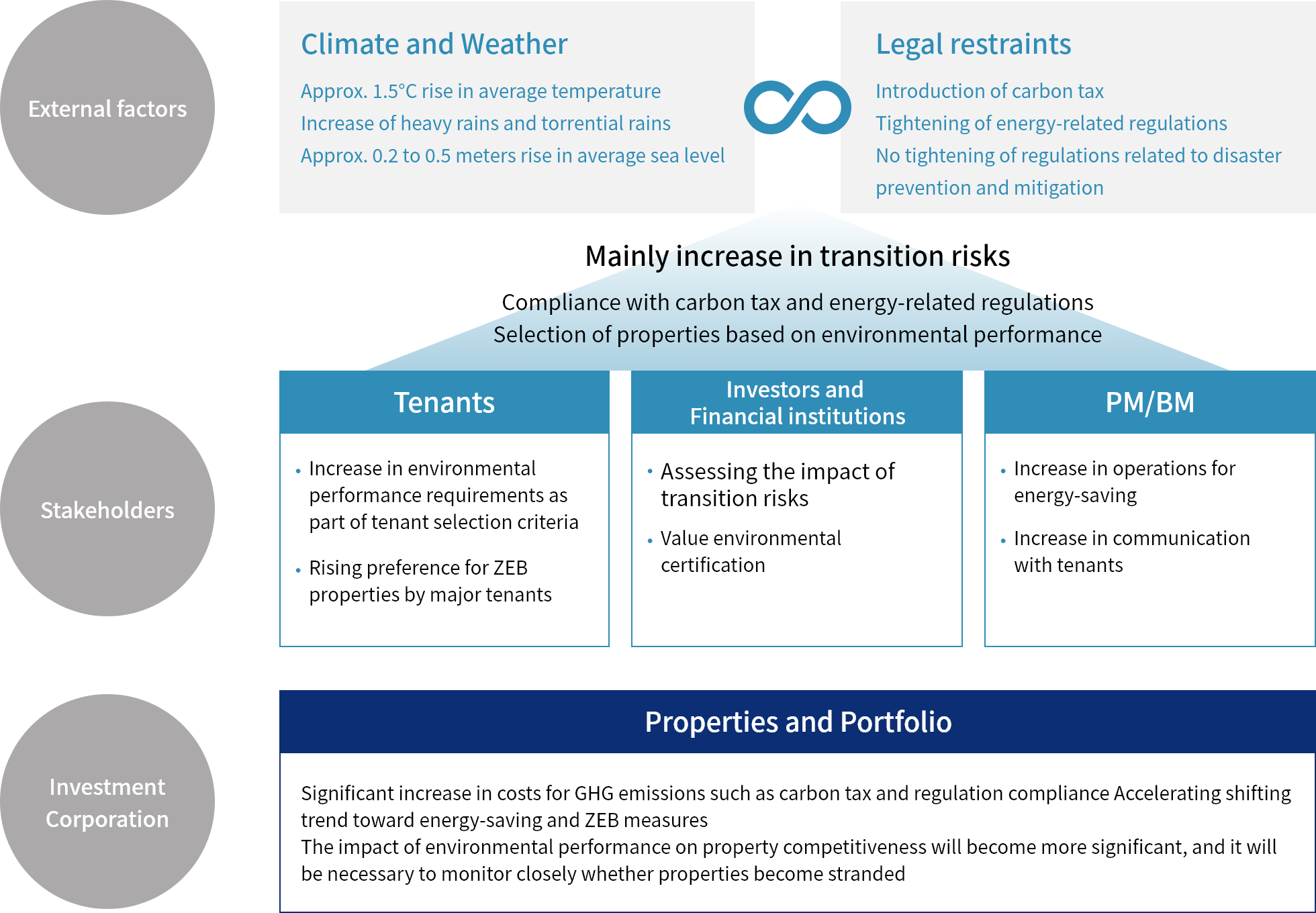

KFM conducted a scenario analysis to identify the risks and opportunities for managed REITs to be posed by the climate change, and to assess their potential impact on managed REIT’s business. World outlook of each scenario is provided below. The analysis was conducted with reference to future climate projections and energy trends published by international organizations.

World Outlook in the 4℃ Scenario

World Outlook in the 1.5℃ Scenario

| Scenarios | Transition risks | Physical risks |

| 4°C Scenario | IEA (International Energy Agency) World Energy Outlook 2020 STEPS | IPCC (Intergovernmental Panel on Climate Change) Fifth Assessment Report RCP8.5 |

| 1.5°C Scenario | IEA (International Energy Agency) NZE2050 | IPCC (Intergovernmental Panel on Climate Change) Fifth Assessment Report RCP2.6 |

Financial Impact based on Scenario Analysis

KFM examined the mid-term (2030) and long-term (2050) impacts of the risks, opportunities, and financial impacts for managed REITs for each of the world outlook in the 4°C and 1.5°C scenario described above. The summary of the evaluation is as follows.

| Risks and Opportunities | Financial impact | Measures to address risks and opportunities | |||||||||||

| Category | Factor | 4℃ Scenario | 1.5℃ Scenario | ||||||||||

| Mid term | Long term | Mid term | Long term | ||||||||||

| Transition Risks and Opportunities | Policy and legal | CO2 emission regulation Introduction of CO2 emission regulations as a measure to comply with international frameworks incur costs and risks related to CO2 emissions. | Increase in costs to improve energy efficiency of existing properties | Low | Low | Low | Mid | Improvement of energy-saving in existing properties Establishment of GHG reduction targets | |||||

| Carbon tax The introduction of carbon tax as a measure to comply with international frameworks incur costs and risks related to CO2 emissions. | Increase in carbon tax costs | Low | Low | Mid | High | Introduction of renewable energy Acquisition of non-fossil certificates, etc. | |||||||

| Increase in acquisition costs of non-fossil certificates, etc. | Low | Low | Mid | Mid | |||||||||

| Technology | Advancement of energy-saving and renewable energy technologies Further technology advancement will result in lower installation costs and effective achievement of energy-saving and renewable energy. | Increase in costs due to introduction of new technology | Low | Low | Low | Mid | Energy-saving in existing properties | ||||||

| Decrease in utility costs due to energy-saving, introduction of renewable energy, conversion to ZEB/ZEH, etc. | Low | Low | Low | Mid | Acquisition of ZEB/ZEH properties Conversion of existing properties to ZEB/ZEH | ||||||||

| Markets | Evaluation by investors and financial institutions Investors and financial institutions will value improvement of the environmental performance of properties. | Increase in financing costs due to low valuation | Low | Low | Low | Low | Energy-saving in existing properties Acquisition of environmental certifications Improvement of engagement with investors and financial institutionsUtilization of green finance | ||||||

| Decrease in financing costs due to high valuation | Low | Low | Low | Low | |||||||||

| Focus on environmental certification Environmental certification will be required for portfolio evaluation by investors and financial institutions as well as property selection by tenants. | Increase in cost of actions to improve evaluation | Low | Low | Low | Low | Acquisition of environmental certifications | |||||||

| Increase in acquisition costs of environmental certifications | Low | Low | Low | Low | |||||||||

| Reputation | Tenant behavior change due to environmental orientation Environmental performance of properties will become valued due to regulation compliance and changing preferences. | Low environmental performance properties becoming stranded | Low | Low | Mid | Mid | Energy-saving in existing properties Acquisition of environmental certifications Engagement | ||||||

| Maintain and improve occupancy rates by improving environmental performance | Low | Low | Mid | Mid | |||||||||

| Tenant behavior change due to disaster-prevention orientation Disaster prevention aspect of properties will become valued due to increasing disasters caused by rising temperatures and sea level. | Low resilience properties becoming stranded | Mid | Mid | Low | Low | Due diligence on acquisition Flood risk analysis of properties Improvement of resilience Engagement | |||||||

| Maintain and improve occupancy rates by improving resilience measures | Mid | Mid | Low | Low | |||||||||

| Physical Risks and Opportunities | Acute | Intensification of heavy rains and torrential rains The frequency of property damage will increase due to severe wind and extreme flood. | Increase in disaster recovery costs | Mid | Mid | Low | Low | ||||||

| Decrease in rental income during the recovery period | Mid | Mid | Low | Low | |||||||||

| Chronic | Rise in sea level Chronic rise in sea level. | Increase in costs to cope with sea level rise | Low | Low | Low | Low | |||||||

| Rise in average temperature Chronic rise in average temperatures. | Increase in utility costs during summer | Low | Low | Low | Low | Energy-saving in existing properties | |||||||

Risk Management

Risk Management System for Climate Change

Listed REIT Department of KFM and the Sustainability Committee identifies and evaluates the sustainability and ESG-related risks of KFM and managed REITs. These sustainability and ESG-related risks are managed on a daily basis by each department in charge, and important risks are analyzed and reviewed regularly by the Sustainability Committee under the supervision of the Chair of the Sustainability Committee, and are managed appropriately. In addition, these risks are incorporated into the organization’s overall risk management by sharing them with relevant parties as necessary.

Metrics and Targets (KDXR)

KPIs related to Climate Change

Responding to climate change is one of the important social issues, and initiatives for climate change countermeasures are accelerating domestically and internationally. KDXR has set GHG emission reduction goal (KPI) as follows in order to actively promote the reduction of environmental impact and contribute to sustainability of environment through the mid- to long-term reduction of GHG emission in our portfolio.

| GHG emission reduction targets(Note1) | 2030 Targets (2022 baseline) | 2050 Targets |

|---|---|---|

| Total amount: 42% reduction Per unit: 42% reduction(Note2) | Net-zero | |

| Scope1 and 2 | Scope1, 2 and 3 |

GHG emission for each fiscal year is estimated by the Asset Management Company using emission factors (adjusted emission factors) by electric utility in “Greenhouse Gas Emissions Calculation, Reporting, and Publication System” of the Ministry of the Environment. The figures are the total of Scope 1, 2 and 3, and the calculation methods of GHG emissions after FY2021 and prior to FY2020 are different.

Scope 1: Direct emission from fuel combustion

Scope 2: Indirect emissions from the use of externally procured electricity and heat

Scope 3: Total emissions minus Scope 1 and Scope 2

Note2:

The intensity is calculated by dividing the GHG emission for each year by the total floor area, considering the occupancy rate of each owned property.

KDXR has obtained Science Based Targets (SBT) certification for the above GHG emission reduction targets.

For further details concerning Science Based Targets (SBT), please refer to Awards and Initiatives.

KDXR has set reduction goal (KPI) of energy consumption (mid- to long-term targets) as follows:

| Goal (KPI) for energy consumption | Reduce unit energy consumption by an average of 1% or more per year over the past five years in accordance with the Act on Rationalizing Energy Use (Energy Saving Act) Set individual goal for properties subject to local regulations related to cope with global warming |

|---|

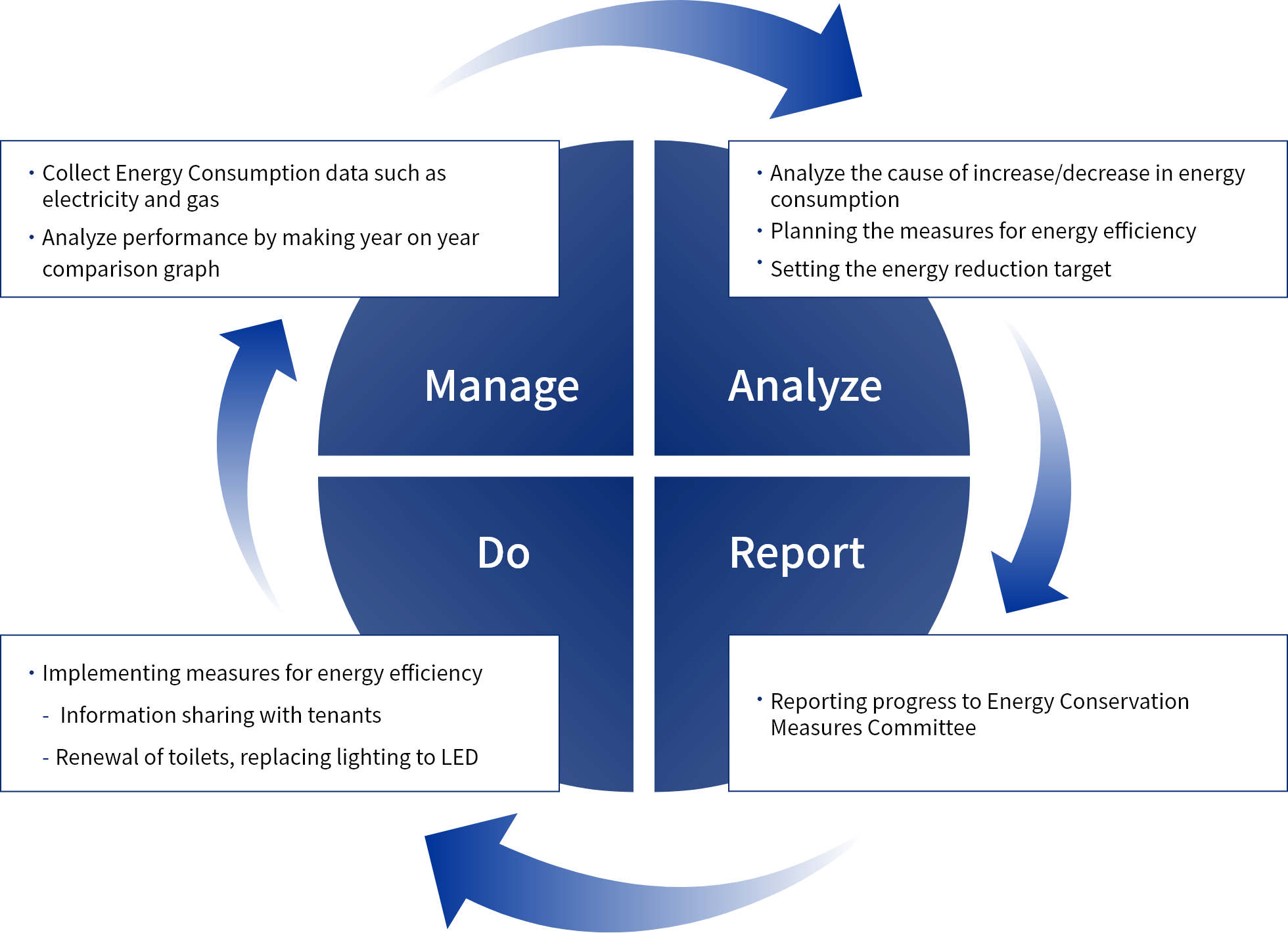

Process to Promote Sustainability/PDCA Cycle

KFM and managed REITs has established PDCA process as below to achieve the mid- to long-term goal on reduction in GHG emissions, energy consumption and others, and been monitoring and assessing environmental performance on energy consumption at the Sustainability Committee held on regular basis.

Environmental Performance(KDXR)

GHG emissions

| 2022 (Baseline) | |

|---|---|

| GHG emission (t-CO2) (Note 1) | 100,349 |

| Scope 1 | 1,592 |

| Scope 2 | 40,036 |

| Scope 3 (Category 13) | 48,720 |

| Intensity (t-CO2/m²) (Note 2) | 0.055 |

| Change in total amount (%) | – |

| Change in intensity (%) | – |

GHG emission for each fiscal year is estimated by KFM using emission factors (adjusted emission factors) by electric utility in “Greenhouse Gas Emissions Calculation, Reporting, and Publication System” of the Ministry of the Environment. The figures are the total of Scope 1, 2 and 3, and the calculation methods of GHG emissions after FY2021 and prior to FY2020 are different.

Scope 1: Direct emission from fuel combustion

Scope 2: Indirect emissions from the use of externally procured electricity and heat

Scope 3: Total emissions minus Scope 1 and Scope 2

Note 2:

The intensity is calculated by dividing the GHG emission for each year by the total floor area, considering the occupancy rate of each owned property.

Energy and water consumption

| 2022 | |

|---|---|

| Energy consumption (MWh) | 472,800 |

| Intensity (MWh/m²) (Note) | 0.240 |

| Water consumption (m³) | 2,502,296 |

| Intensity (m³/m²) (Note) | 1.273 |

The intensity is calculated by dividing each consumption by the total floor area, considering the occupancy rate of each property.

Independent Assurance Statement

GHG emission and energy and water consumption in 2022 have been assured by a third party, Sustainability Accounting Co., Ltd.

Independent Assurance Statement (KDO) (266KB)

Independent Assurance Statement (KDR) (266KB)

Independent Assurance Statement (KRR) (266KB)

Reduction of Environmental Burden

Installation of LED lightings

We promote to convert lightings in common area, tenant area, etc. and emergency lights (including emergency guide lights) to LED to actively promote reduction of electricity consumption.

We will continue to convert lightings in tenant area by promoting Green Lease based on discussions with tenants in a planned way as well as in common area.

Solar panel installation

We installed solar panels at our properties to decrease GHG emissions.

| Power generation results | |

|---|---|

| Unicus Ina | 307,655 kWh |

| Kawamachi Yahagi Mall | 292,328 kWh |

| Apita Terrace Yokohama Tsunashima | 27,986 kWh |

| Tenri Distribution Center | 144,756 kWh |

| Monenosato Mall | 494,663 kWh |

| Yumemachi Narashinodai Mall | 264,818 kWh |

Greening of facilities

Greening of facilities creates energy-saving effects such as mitigation of outdoor temperature, as well as relaxing effects for customers, providing refreshing spaces. In particular, rooftop greening at commercial facilities provides not only physical environmental improvement effects such as improved thermal environment, but also promotes a healing effect for users of the properties owned, providing them with a place to relax.

Water conservation initiatives

We are working to reduce water consumption by introducing toilets with water-saving functions and installing rainwater tanks in our properties.

Remote Surveillance of Road Heating

We have installed remote surveillance systems for snow melting equipment at four residential properties in Sapporo. Remote surveillance has significantly reduced the cost of fuel for keeping outdoor areas free of snow.

Installing Secure Lockers for Deliveries

Secure lockers for parcels eliminate the need for delivery companies to return to a property when a resident is not home the first time. This reduces transportation GHG emissions and wasted working time for drivers.

Stakeholder Engagement to Improve Property Performance

KFM and managed REITs are continuously making effort to realize sustainable environment, we think it is crucial to cooperate with our tenants who constantly use our properties. KFM and managed REITs are aiming to cooperate by taking initiatives to raise awareness and promoting green lease that allow both owner and tenant to share economic merit to achieve sustainable environment.

KFM and managed REITs have identified “tenant engagement to improve environmental performance” as material topic and been making contribution through promoting tenant cooperation and cooperating with other stakeholders such as property management companies who actually manage the building and employees in the Asset Management Company who manage the properties.

Proper measures for hazardous substances, soil contamination and other materials requiring special handling

Before acquiring a property and in conjunction with other transactions, we thoroughly examine properties by receiving an engineering report that covers the building’s structure and facilities, including environmental items. We also receive an earthquake probable maximum loss assessment, a soil contamination survey and other information. These activities ensure that the building complies with laws and regulations.

The engineering report includes a confirmation that a building is free of asbestos, PCBs and fluorocarbons. If any hazardous substances are discovered, appropriate actions are taken, such as by establishing counter-measures, managing or disposing of these substances, in accordance with laws and regulations.

If a property we plan to acquire has soil contamination, we make the investment only after the completion of soil contamination counter-measures.

Brownfield Development at Yokohama Connect Square

Kenedix Group is promoting a large-scale development project in the 37th district of Yokohama Minato Mirai Central District in collaboration with our partner companies. For this project, Kenedix Group is contributing approximately 1 billion yen to take appropriate measures to deal with soil contamination such as removal of contaminated soil and installation of water shielding walls, etc.

Green Lease

KFM conducted LED lighting installation works for a part of a tenant office space at the expense of managed REITs based on the Agreement. A certain ratio of the highly reduced amount of electricity charges and maintenance costs (costs for exchanging fluorescent bulbs) has been paid from the tenants in return as Green Lease fee.

What is Green Lease?

It is an agreement specifying that building owners and tenants shall cooperate with each other to reduce environmental burden. The agreement contains provisions to facilitate renovation toward more environmentally-friendly office buildings by reducing building owners’ investment burden through sharing the economic merits generated as a result of energy-saving renovation works among building owners and tenants. It also contains an agreement to streamline operations for energy saving, water saving and enhancing indoor conditions.

Promoting Lease Agreement with Clause for Environmental Cooperation

We have promoted including clause to cooperate to improve environmental performance of the property, comfort and productivity of our tenant into its base contract, etc.

Cooperation with Property Management Companies

KFM and managed REITs are engaging with property management companies to share our vision, policies of sustainability and when making contract with a new tenant, property managent companies explain these ideas to tenants to achieve their cooperation.

Education to Employees on Green Building

KFM provides annual sustainability training by external specialists to improve awareness and knowledge on green building for its employees.