- TOP

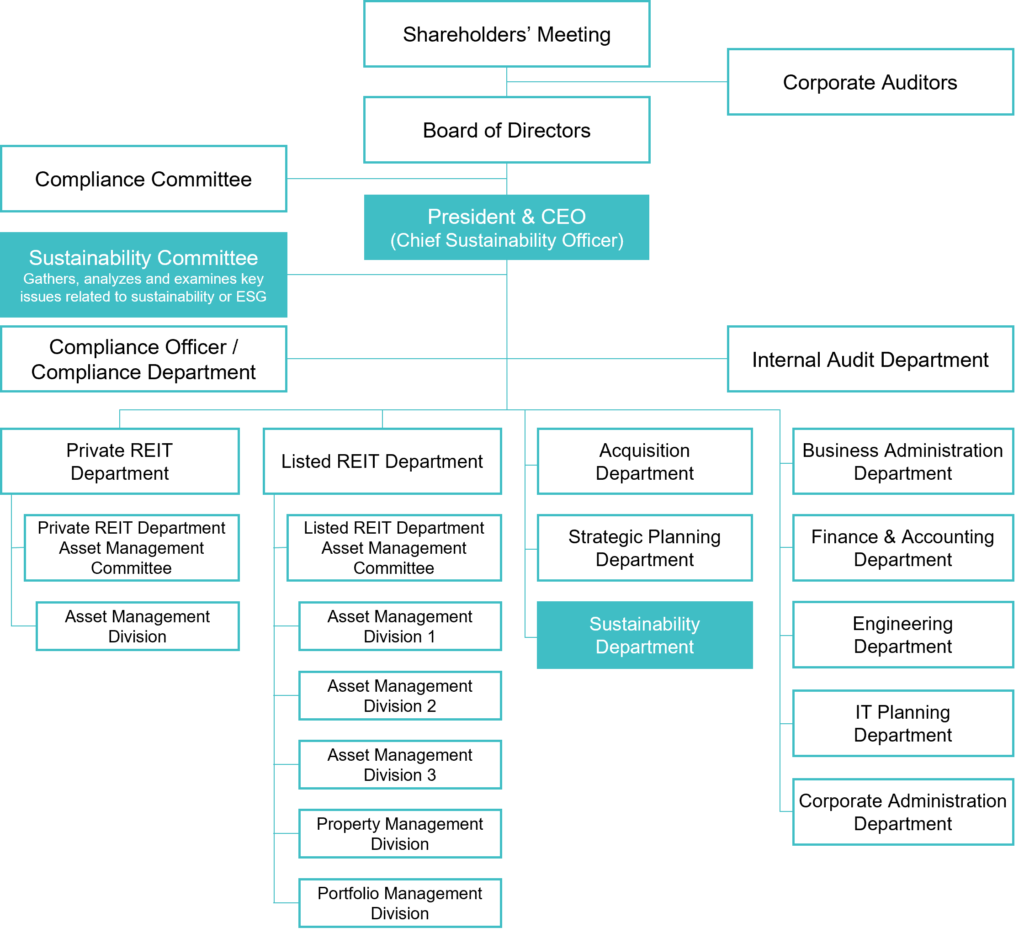

- ESG Policies / Management System

ESG Policies / Management System

Kenedix Real Estate Fund Management, Inc (“KFM”),

KDX Realty Investment Corporation(“KDXR”), and Kenedix Private Investment Corporation(“KPI”) have positioned initiatives on ESG (Environment, Social and Governance) awareness as an important business management issue. To promote ESG initiatives, KFM has established the following Sustainability Policies.

Sustainability Management System

Sustainability Committee

The initiatives for sustainability are promoted under the leadership of the Sustainability Committee organized by KFM.

The Sustainability Committee is chaired by the President & CEO (Chief Sustainability Officer), and consists of the following members.

| Chair (Convener/President) | President & CEO (Chief Sustainability Officer) |

|---|---|

| Committee Members | Head of each REIT Department Head of Strategic Planning Department Head of Sustainability Department General Manager (each REIT) of Strategic Planning Department Head of Strategic Planning, each REIT Department Head of Asset Management Division of each REIT Department Head of Portfolio Management Division of Listed REIT Department Head of Finance & Accounting Department Head of Corporate Administration Department |

| Observers | Head of Public Relations & Sustainability Department of Kenedix, Inc. Others designated by the Chair |

| Secretariat | Sustainability Department |

| Frequency of meetings | Once in three months |

| Functions | The Sustainability Committee gathers, analyzes and examines the policies, targets, activity plans, various initiatives, risk management, and other important sustainability and ESG related matters for KFM, KDXR and KPI, and shares them with related parties, with the aim of promoting initiatives for sustainability and ESG-related matters. Depending on the contents, the discussions are reported to KFM’s Board of Directors, to KDXR’s Board of Directors and to KPI’s Board of Directors with independent supervisory directors. |

Materiality

The Kenedix Group has established material issues that are critical for achieving sustainable growth of the Kenedix Group along with its stakeholders and society. We will make commitment to find solutions to these issues both in business and society by making initiatives that reflect the opportunities and risks associated with each issue. Furthermore, we intend to contribute to achieving the SDGs by carrying measures for our materiality.

Process of Defining Materiality

- Step 1.

Identify and study ESG issues- We examined ESG issues by creating a long list that covers Global Reporting Initiative, the evaluation items used by multiple ESG evaluation organizations, the SDGs.

- Step 2.

Cross check with business issues- After once again studying business issues at the Kenedix Group, we selected a list of issues that should be considered from the standpoint ob both in our business operations and society.

- Step 3.

Examine issues based on input from Kenedix Group companies- The list was discussed among relevant departments and group companies that are involved, external professionals, and other stakeholders to select the issues that are most important to the Kenedix Group from the standpoint of both business operations and society.

- Step 4.

Final discussion at senior management- Board of directors of Kenedix, Inc. defined the material issues after final discussion led by the President and CEO of Kenedix, Inc., including auditors.

Kenedix Group’s Materiality

| Key Areas and Applicable SDGs | Materiality |

|---|---|

| Contribution to a Sustainable Environment | Reduction of energy consumption and GHG emissions |

| Reduction of water consumption and waste materials |

| Collaboration with tenants for environmental initiatives | |

| Commitment to a Diverse Society | Providing properties with environmental and social considerations |

| Improving resilience/climate adaptation |

| Initiatives for an aging society with fewer children | |

| Stakeholder Engagement | Continuous improvement of customer satisfaction |

| Community engagement |

| Managing conflicts of interests | |

| Attractive Working Environment | Recruiting, employee retention and career advancement |

| Health and wellbeing of employees |

| Diversity and equal opportunities | |

| Responsible Organization | Compliance |

| Risk management |

| Commitment to responsible investments |

Sustainability Policies

As materiality is defined, we have set comprehensive Sustainability Policies regarding ESG. The Kenedix Group will adhere to the Sustainability Policies to promote specific initiatives towards materiality.

- Contribution to a Sustainable Environment

- Improving the environmental performance of the properties we manage is one of our social missions We will lower the environmental impact and make contribution to environmental sustainability by constantly reducing the negative environmental impact of these properties, such as energy consumption, GHG emissions, water consumption and the generation of waste materials. We also have activities for the proper management of hazardous substances and reduction in their use.

- Commitment to a Diverse Society

- We contribute to the diversity of society while taking into account the social impact of our properties. We are committed to maintaining safety, confidence, good health, comfort and diversity regarding our tenants and the communities where we operate.

- Stakeholder Engagement

- We manage our properties as a responsible real estate asset management company by stressing the importance of engagement with our stakeholders such as investors, tenants, business partners, communities and property management companies.

- Attractive Working Environment

- We aim to maintain an attractive working environment by implementing measures for employees’health and wellbeing and for diversity and equal opportunities. To enable employees to realize their full potential, we will provide a variety of training programs and other educational opportunities.

- Responsible Organization

- We have sound compliance and risk management activities in all our business activities. We are committed to the principle of responsible property investments by a responsible organization by aligning our operations with global EGS initiatives and actively disclosing ESG information.

Awards and Initiatives

KFM, KDXR and KPI proactively utilize the following evaluation programs by external organizations and support the following domestic and international initiatives to continue improving the sustainable asset value of its properties.

GRESB Real Estate Assessment

KDXR was the first J-REIT to participate in the “GRESB Real Estate Assessment” in 2011, an annual benchmarking assessment for real estate companies and funds. Since then, we have been awarded “Green Star” for 12 consecutive years by achieving high performance both in “Management Component,” which evaluates policies and organizational structures for ESG promotion, and the “Performance Component,” which assesses environmental performance and tenant engagement at properties owned.

In the 2023 GRESB Real Estate Assessment, KDXR earned the highest evaluation of “5 Stars” for second consecutive year . Moreover, KDXR have received “A” rating, the highest level of ESG-related information disclosure.

Support for TCFD recommendations

KFM expressed its support for the recommendations made by the Task Force on Climate-related Financial Disclosures (“TCFD”) and also joined the TCFD Consortium, a group of domestic companies that support TCFD recommendations in October 2021.

TCFD is an international initiative established by the Financial Stability Board (“FSB”) at the request of the G20 for the purpose of discussing the disclosures of climate-related financial information and the responses by financial institutions. TCFD publishes recommendations for companies to disclose their governance, strategy, risk management, and metrics and targets for climate-related risk and opportunities.

Moreover, TCFD Consortium is a group of companies and financial institutions that support the TCFD recommendations. Consortium was established with a view to further discussion on effective corporate disclosures of climate-related information and initiatives to link disclosed information to appropriate investment decisions on the part of financial institutions and other organizations.

KFM, KDXR and KPI will work to expand information disclosure based on TCFD and continue to actively promote ESG (Environment, Social and Governance) initiatives based on “Sustainability Policies” established by KFM.

Science Based Targets initiative(SBTi)

KDXR has obtained Science Based Targets (SBT) certification for GHG emission reduction targets.

Science Based Targets are GHG emission reduction targets certified as science-based by the Science Based Targets initiative (“SBTi”), an international joint initiative established in 2015 by CDP, the United Nations Global Compact, the World Resources Institute (WRI) and the World Wide Fund for Nature (WWF). In order to acquire SBT Certification, the targets must be consistent with the levels required by the international framework, the Paris Agreement (to reduce the increase in global average temperature due to climate change to a maximum of less than 2 degrees Celsius above the level during the Industrial Revolution).

For details on our GHG emission reduction targets, please refer to Environmental Initiatives.

Signing to PRI

PRI comprises an international network of investor signatories that works to realize the Six Principles established for the financial industry in 2006 under the leadership of then United Nations Secretary-General, Kofi Annan.

PRI encourages the incorporation of ESG issues (Environment, Social and Governance) into investment decision-making processes, with the aim to help companies enhance long-term investment performance and better fulfill their fiduciary duty.

Kenedix, Inc. the parent company of KFM, has signed to the PRI and is ambitious to become a real estate asset management company that commit responsible investment through the practice of PRI.

Signing to PFA21

PFA21 (Principles for Financial Action for the 21st Century) has been established by drafting committee with participation of various financial institutions in October 2011 as the action guidelines of financial institutions who seek to fulfill their responsibilities and roles required for the formation of a sustainable society. Signing financial institutions will implement initiatives based on the seven principles as much as possible based on their own businesses. It has been positioned as a starting point to collaborate without being restricted by business categories, scale or region.

Kenedix, Inc. and KFM have signed to the PFA 21 and are ambitious to become real estate asset management companies that commit to responsible investment through the practice of the PFA21.

Certification of Health & Productivity Management Outstanding Organizations

Through the implementation of various initiatives related to health management, KFM has been certified as a “Health & Productivity Management Outstanding Organization 2023 (large enterprise category)” by Nippon Kenko Kaigi, which recognizes organizations that practice excellent health & productivity management.

The certified health & productivity management outstanding organizations recognition program is a program that recognizes large corporations, small and medium-sized companies, and other corporations that practice particularly excellent health management as “organizations that think about employee health management from a managerial perspective and engage in it strategically,” based on initiatives that meet local health issues and health promotion initiatives promoted by Nippon Kenko Kaigi.